Example of Cameroon

Offshore Development in progress

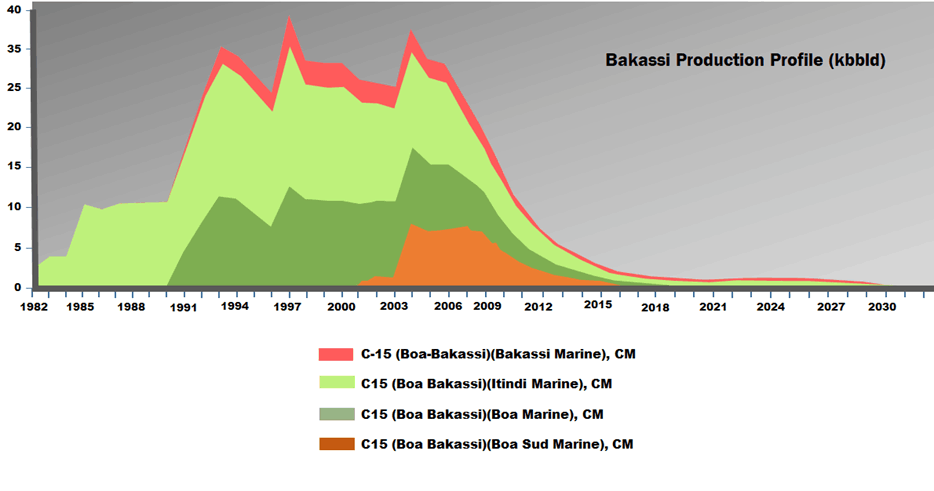

225 mmbbs STOIIP;

Well Head Jacket,

FPSO Processing and Gas Export

• Oil development scheme

• Assumes water injection.

• 1st production assumed 2024-2025.

• All hydrocarbon processing on existing FPSO.

• Gas for own fuel and domestic GTE.

• Gas for Exportation

• Clients already identify